Medicare at Peters & Milam

BECOMING MEDICARE ELIGIBLE?

Turning 65 is an extremely important time in your life. It is at this age you are now eligible for Medicare and Guaranteed Issue for supplemental health insurance. Give us a call for a clear and concise explanation of Medicare and supplemental insurance policies - and take a moment to review the resources below! We want you to make an educated decision that’s best for you!

What Medicare plans are best for you?

Original Medicare

Supplemental Plans

-

Medicare Part A covers;

-Most inpatient hospital care

-Certain care in a skilled nursing

facility (SNF)

-Certain home health services

-Certain hospice careYou will not pay a Part A monthly premium if you are eligible for Social Security retirement benefits (meaning you have 40 or more quarters of Social Security credits — approximately 10 years of full-time work, 4 quarters per year) or Railroad Retirement benefits. If you have 30-39 quarters of Social Security credits, you may buy Part A coverage and pay a monthly premium of $278 in 2024. If you have 0-29 quarters of Social Security credits, you may buy Part A coverage and pay a monthly premium of $505 in 2024.

-

Medicare Part B covers a portion of:

-Doctors’ services

-Outpatient hospital care

-Laboratory tests

-Outpatient physical therapy

-Outpatient speech therapy

-Certain home health care

-Certain ambulance services

-Certain medical equipment and suppliesPart B coverage is optional. If you or your spouse is still working and covered by your employer group health plan, you may not need this part of Medicare until you or your spouse retires.

The standard Medicare Part B premium for 2024 is $174.70. Most people pay the standard premium, and have it automatically deducted from their Social Security check every month or billed quarterly from Social Secuirty. Beneficiaries with higher incomes will pay higher Part B premiums known as IRMAA (Income Related Modified Adjustment Amount). Click here to read more about Medicare costs.

-

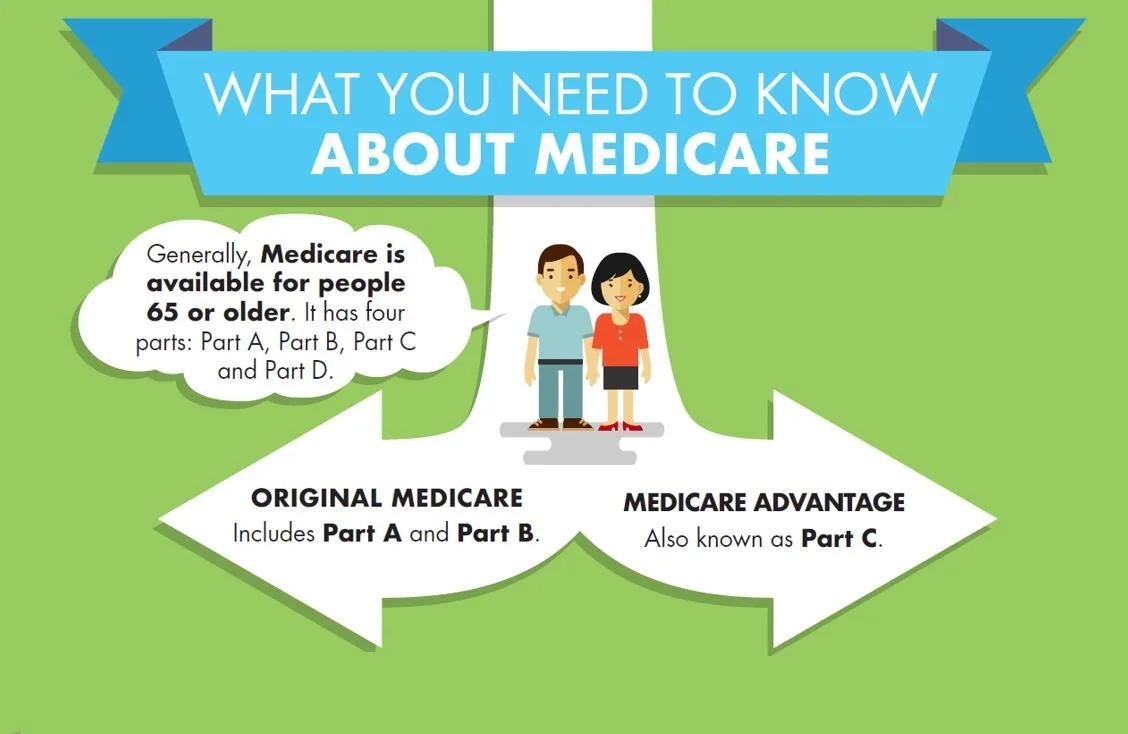

Most people sign up for both Part A (Hospital Insurance) and Part B (Medical Insurance) when they’re first eligible during their Initial Enrollment Period (usually when they turn 65). You can apply for your Medicare three months prior to your birthday month, your birthday month, and three months after. Generally, there are risks to signing up later, like a gap in your coverage or having to pay a penalty. However, in some cases (like having credible employer sponsored coverage), it might make sense to sign up later.

You can apply for your Medicare Part A and Part B by visiting; www.ssa.gov/medicare you can also apply by phone 1-800-772-1213 or in person by visiting your local Social Security Administration office.

If you miss or delay your enrollment period, you might qualify for a Special Enrollment Period. Learn more about Special Enrollment Periods for Original Medicare.

-

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

Part A (premium free); Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)Part B: Coverage starts based on the month you sign up:

If you sign up before the month you turn 65 coverage starts the month you turn 65.

If you sign up the month you turn 65 or during 3 months after, coverage starts the next month.

-

Medicare Advantage Plans are another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage (Part D). In most cases, you’ll need to use health care providers who participate in the plan’s network. These plans set a limit on what you’ll have to pay out-of-pocket each year for covered services. Some plans offer non-emergency coverage out of network, but typically at a higher cost. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because you may need to use your Medicare card for some services. Also, you’ll need it if you ever switch back to Original Medicare. Below are the most common types of Medicare Advantage Plans.

Health Maintenance Organization (HMO)

Preferred Provider Organization (PPO)

Private Fee-for-Service (PFFS)

Special Needs Plans (SNPs)

-

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay remaining health care costs. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the Medicare-Approved Amount for covered health care costs. Then, your Medigap insurance company pays its share. These plans are guranteed renewable, meaning the benefits will not change year to year.

A good time to review your Medicare Supplement is annually during your Birthday Rule; you have 60 days from the first day of your birth month to change to another Medigap plan with the same level or a lower level of benefits. You can also change insurance carriers during this time.

-

Open Enrollment runs October 15th -December 7th each year.

Anyone on Medicare (with either Part A or Part B) is entitled to drug coverage (known as Part D) regardless of income. For most people, joining Part D is voluntary. However, if you now get your drugs from Medicaid, you must get them from a Medicare drug plan as soon as you become eligible for Medicare. You won’t need to sign up if you have other drug coverage that is better than Medicare’s — for example, benefits from a current or former employer or union. But if you don’t have other drug coverage that’s considered as good as Medicare, and you delay signing up, you’ll incur a late penalty that adds to your premiums for as long as you’re in the program, except in certain circumstances, and you’ll be able to enroll only during open enrollment at the end of the year. -

You can join, switch, or drop a Medicare Health Plan or a Medicare Advantage Plan (Part C) with or without drug coverage during these times:

Initial Enrollment

When you first become eligible for Medicare, you can join a plan.Birthday Rule (Medicare Supplement) ; you have 60 days from the first day of your birth month to change to another Medigap plan with the same level or a lower level of benefits. You can also change insurance carriers during this time.

Open Enrollment (Part D and Medicare Advantage)

From October 15 – December 7 each year, you can join, switch, or drop a plan. Your coverage will begin on January 1 (as long as the plan gets your request by December 7).Medicare Advantage Open Enrollment

From January 1 – March 31 each year, if you’re enrolled in a Medicare Advantage Plan, you can switch to a different Medicare Advantage Plan or switch to Original Medicare (and join a separate Medicare drug plan) once during this time. Note: You can only switch plans once during this period.ext goes here

There are other situations that provide Special Enrollments, click here to read more about Special Enrollments.

REQUEST A MEDICARE PLAN COMPARISON BELOW

PLEASE NOTE: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1- 800-MEDICARE to get information on all of your options.

• Medicare Part A (Hospital Insurance)

• Medicare Part B (Medical Insurance)

• Medicare Part D (Prescription Plan)

•Learn about Medicare’s Parts

•Find out what Medicare covers

•Enrollment Periods of Medicare

•Medicare Supplement Insurance

• What Medigap policies cover

• Your rights to buy a Medigap policy

SPEAK WITH A CERTIFIED MEDICARE ADVISOR AT PETERS & MILAM 805-687-3225

LEARN MORE ABOUT MEDICARE PART D

You can create your own comparison by watching our Part D Enrollment tutorial & then clicking the button below - it will redirect you to the Medicare website where you will be able to enter your drug information, pharmacy info, etc. Please contact our office if you have any questions or need assistance 805-687-3225 or info@petersmilam.com.

READ THE BLOG • MEDICARE

SEND US AN EMAIL

Have questions about Medicare policies and supplements? Fill out the form below and one of our Medicare agents will get back to you as soon as possible! Please note that during Open Enrollment season (October 15 - December 15), our response times may be longer than usual due to a very high volume of calls & inquiries.